It stands to reason that a good checkout process can help lead to more conversions. Simply put, combining online shopping with a secure, friction-free checkout can help your business increase online and mobile app revenue. Think of it as the "experience equation." Busy consumers want quick, convenient digital experiences, and they'll often reward the merchants who can deliver.

But what does that friction-free checkout experience look like? Creating it requires more than just adopting an easy-to-navigate interface and flow. The key is to use a two-pronged approach that makes the checkout feel simple to users while also retaining the features needed to help safeguard your customers' payment data.

With the help of a payments platform like Braintree, solving the experience equation can be easier than you think.

Make your checkout seamless

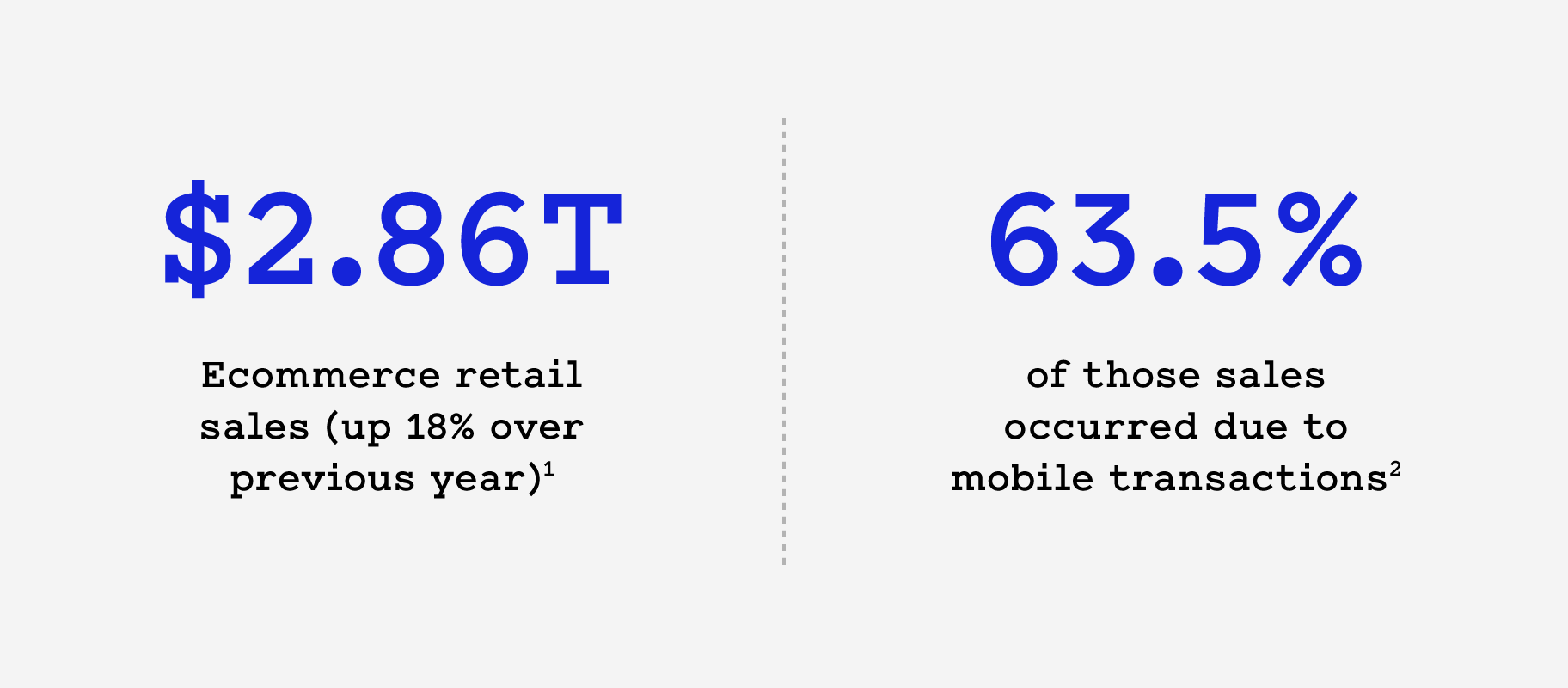

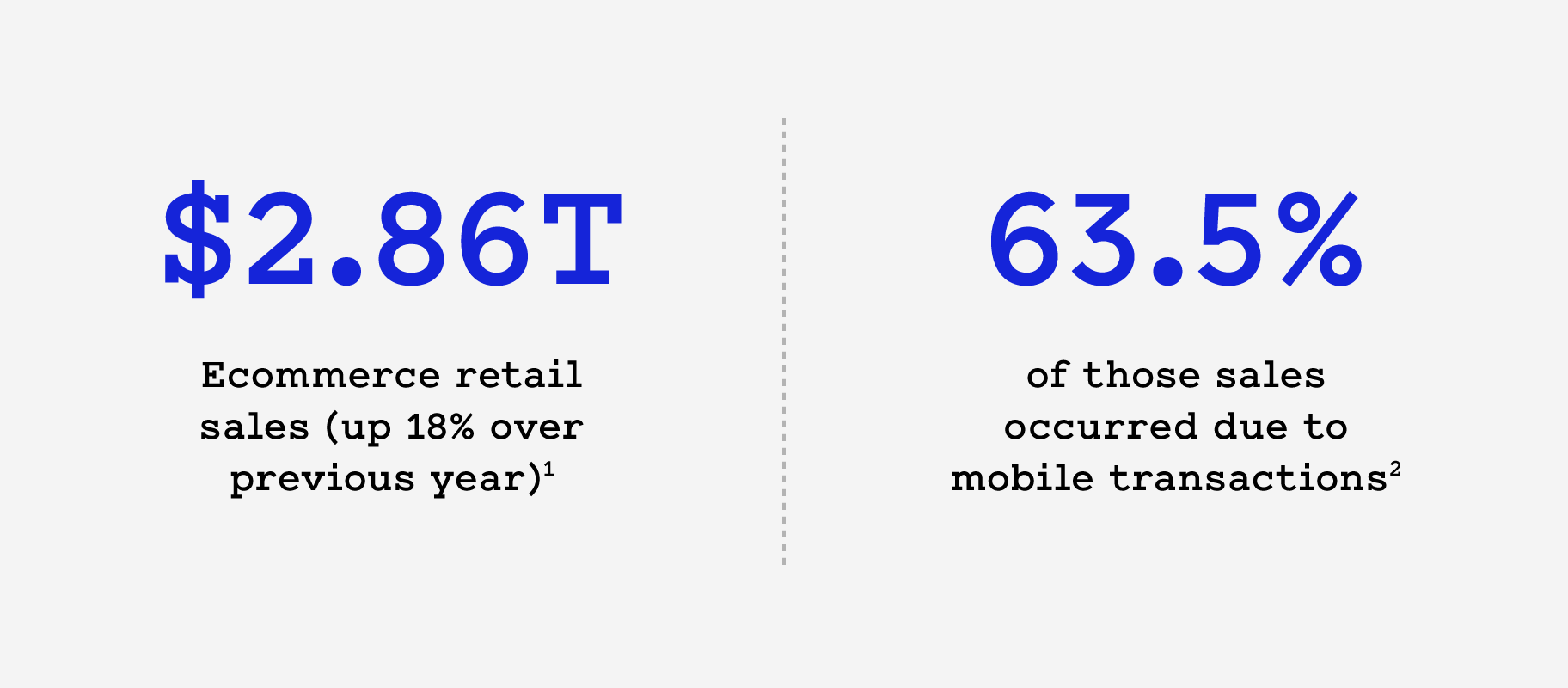

In 2018, global ecommerce retail sales topped $2.86 trillion -- up 18% over 2017.1 Add to that the fact that 63.5% of those sales occurred due to mobile transactions,2 and it's plain to see the ecommerce opportunity is at an all-time high. According to eMarketer, the company behind this new data, consumers are becoming "digitally mature -- moving from browsing to buying" and their time spent online and general purchase frequency will only increase.

The Stanford Persuasive Tech Lab, which is dedicated to exploring how technology design can change people's behaviors and beliefs, recently identified a secret to capturing your share of this growing revenue. The lab's team of UX designers and behavior scientists say that when it comes to influencing behavior, simplicity matters more than motivation.3

In your online checkout, simplicity is synonymous with seamlessness. Consumers expect a smooth process, regardless of whether they're shopping on a desktop computer, tablet, or smartphone. Whittling down your checkout to as few steps as possible can help, but you don't want to do it at the expense of security. That could make it difficult to retain customers and meet your long-term goals of building loyalty and trust.

To achieve those objectives, you need a payments partner that provides a seamless user experience across devices while also prioritizing security on the backend.

Prioritize security

Security is a key part of the experience equation, and merchants are increasingly recognizing the value of a checkout that isn't just friction-free, but also secure. According to Experian's 2019 Global Fraud and Identity Report, 74% of consumers cited security as the most important aspect of their online experience.4

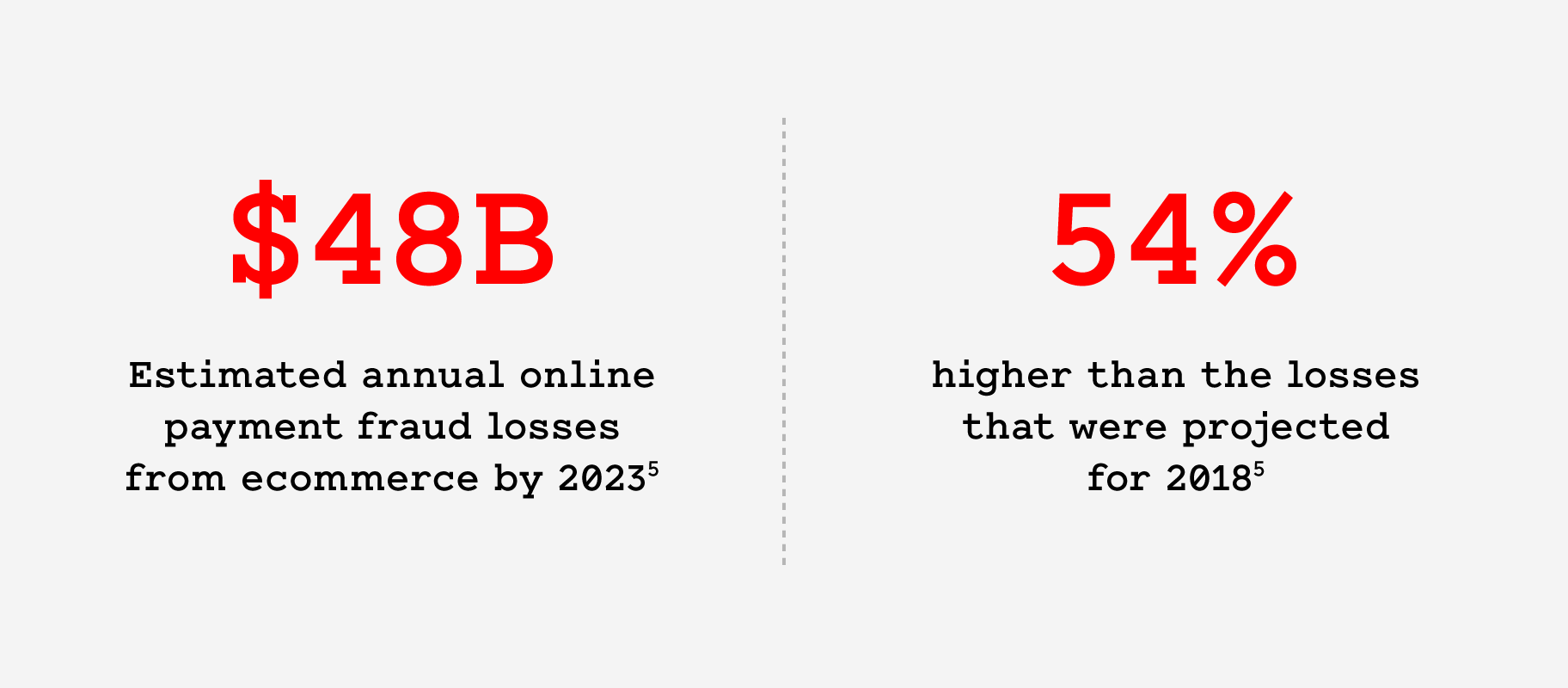

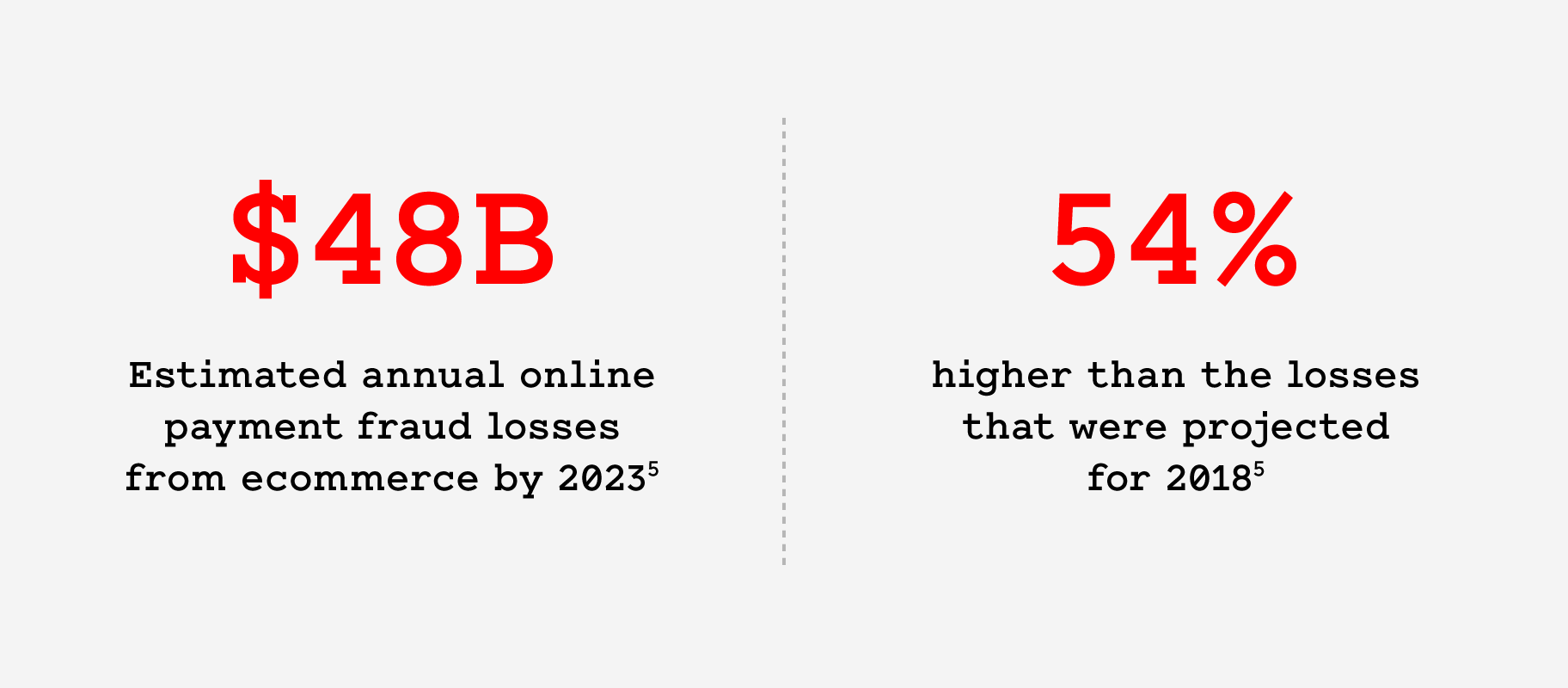

As far as security is concerned, limiting declines is only the beginning. Braintree's basic fraud tools can also help merchants protect themselves against unauthorized purchases and stolen financial information. Juniper Research predicts that annual online payment fraud losses from ecommerce, airline ticketing, money transfer, and banking services will reach $48 billion by 2023; up 54% from the $22 billion in losses that were projected for 2018.5

Braintree can help brands take control of their checkout security by providing access to a dispute team that specializes in resolving issues like chargebacks. Businesses get to offer recognized and trusted payments methods like PayPal, credit, and debit cards in a single integration, along with tools to facilitate management of chargebacks, retrievals, and pre-arbitrations. And the experience for consumers still feels as simple as can be.

When your customers arrive in your online marketplace, they want to discover a checkout experience that serves its purpose and doesn't interfere with the task at hand. Your payments solution should enhance rather than detract from that experience, all while providing the security and ease of management your business needs.

In other words, the experience equation affects both your marketplace and your customers. Are you ready to solve it?

Want to learn more about how Braintree can help you give customers a secure, friction-free checkout experience?

Read the full whitepaper